Leveraging in simple words, means borrowing to finance something.

Is leverage the same as debt? No. Leverage is using debt to finance an asset which fetches higher returns.

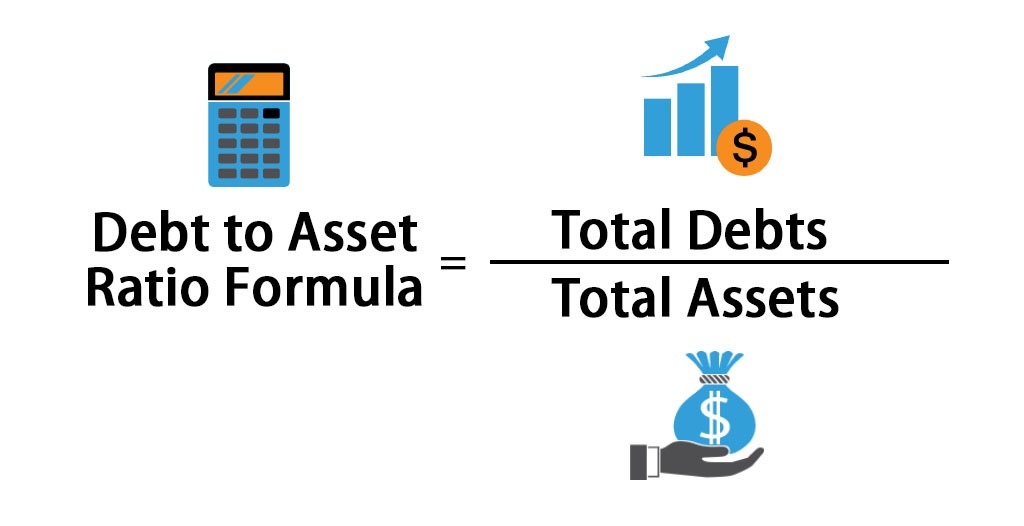

HOW IS LEVERAGE CALCULATED?

Leverage is the total amount of debt (total, not monthly) divided by total assets owned.

A high leverage ratio should ring alarm bells.

- It means that selling off your assets to repay all loans will not leave much behind.

- It means that you are over-leveraged.

HOME LOANS

Home loans constitute 52% of total retail loans in India. The large ticket size of loans contributes to the high proportion. The other two factors are

- the belief that prices of real estate appreciate over time, and that

- most of the borrowers do not have the capital to buy a house with their own resources.

One needs to have an amount equivalent to 20%-25% of the total price, to serve as collateral or down payment. Banks or housing finance companies take care of the rest.

But the actual price you pay for the house is much higher than the buying price. Home loans are typically long-term, spread over a period of 10-25 years, and the total interest paid is more than the principal amount in most cases.

One can expect 6% p.a. rate of appreciation on real estate. If the rate of interest you are paying on the loan is higher than this, you need to think. Tax benefits do count, but the exact amount needs to be calculated and compared.

People do not usually feel the pinch as income increases over the years, making the EMI more and more affordable. The market value of a property which has appreciated gives a lot of comfort, though you may not always liquidate it to meet other needs.

No wonder that people with non-mortgage financial debt report more mental health issues, than home loan borrowers. They see the house as an asset which can be leveraged to meet future needs.

VEHICLE LOANS

When you are on the move, there is nothing better than a shiny new model of a car and a fancy hand-held device to declare your status.

Very few can resist the temptation to buy the latest hot wheels, but think again. The value of a car depreciates as soon as you drive it out of the showroom. It is only an expense.

Car loans should be taken for short periods to reduce the total amount of interest paid. It may be a good idea to buy a good quality used car with your own money.

EDUCATION LOAN

This is a loan that builds a career, a life. Every rupee of interest is worth it, if the borrower is responsible and repays the loan as quick as possible.

Banks often ask parents for collateral in the form of a house or a fixed deposit. In case the child does not repay the loan in future, parents lose a part of their retirement fund.

PERSONAL LOAN

I would describe this as ‘avoidable’ unless there is an emergency. Or if you need money to repay credit card which attracts interest of more than 40% p.a.

Needless to say, interest rates are high because the risk in an unsecured loan is high. Temptation exists everywhere with tele-callers offering a loan 3 times a day, and ads promising money in 5 minutes if you download an app.

The interest paid drains away future prosperity and can cause a lot of distress if you face aggressive recovery methods.

LEVERAGE IN EQUITY TRADING AND CRYPTOCURRENCY

This is commonly called ‘margin trading’. You need to have a certain amount in the wallet or pool account, and the brokerage finances the remaining amount. The idea is to maximise gains by selling at a higher rate.

If the gains are more than the interest paid, it is leveraging for gain.

CREDIT CARDS AND BUY NOW PAY LATER

Here, you leverage future income which is uncertain, usually to satisfy a want or ‘discretionary cost’.

It is a debt trap, if you do not pay the full amount on the due date. You get sucked in the whirlpool of high interest rates, not justified by the impulse you give in to.

If you do not have cash to buy an iPhone or dining table, you cannot afford it now. Wait till you’ve saved enough, instead of opting for a credit card swipe or BNPL option. Do a rent vs. buy analysis.

You will thank your good sense later.

WHEN IS DEBT GOOD?

1. EMIs are negative savings

High spenders can lock in money to finance assets, rather than blowing it up on impulses.

2. Debt locks in a financial outflow

You are committed to paying a certain amount every month. It will become less burdensome as your income grows.

It prevents the uncertainty of brokerage cost, rent, transportation cost for moving house, altered school fees and commuting cost structure on every move you make.

Now, you can have a viable, easy-to-follow financial plan.

3. Keep the loan

You may choose to keep a loan going and not repay it fully, to build an emergency fund. You may also earn higher returns if your savings are invested in equity or other assets which yield higher returns.

HOW CAN DEBT BE SECURED?

1. Buy insurance

It can be life insurance, general insurance or loan protection insurance. It allows you to live in peace.

2. Have a back-up asset

Rent from a second residential or commercial property can cover your monthly loan instalment. It can also be sold off to repay the full loan for the self-occupied property, should the need arise.