“Power of compounding is the eighth wonder of the world”.

The quote is attributed to both Albert Einstein and Warren Buffet. We see many videos and charts demonstrating the magic of how your money can grow, if invested at the right time in the right manner.

Let me reiterate the lesson with a short video.

What is power of compounding? It is nothing but earning higher returns, when both the principal amount and returns are reinvested together, repeatedly. Returns keeps compounding and the magic manifests after a given period of time.

WHY IS COMPOUNDING IMPORTANT?

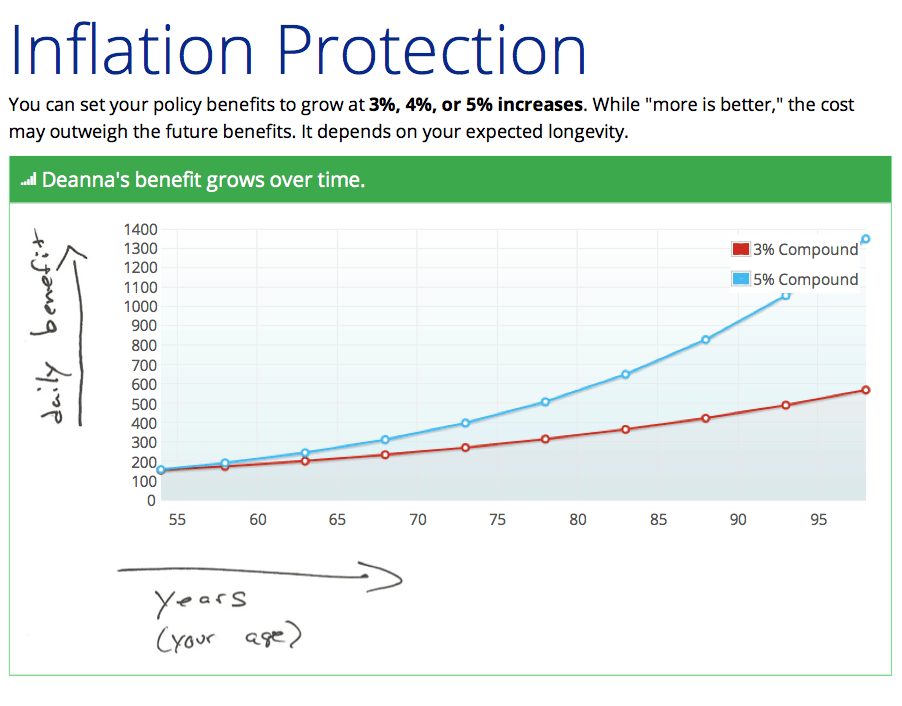

Compounding is important, because it offsets the loss of value by inflation.

We do not intend taking anything away from the magic. We just address the people who are disappointed when the magic does not light up their net worth statements.

WHEN DOES POWER OF COMPOUNDING FAIL TO DELIVER?

1. TIME FACTOR IN POWER OF COMPOUNDING

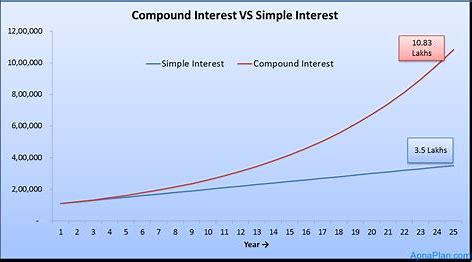

See a popular chart depicting power of compounding.

You can see that the simple and compound interest graphs move together for some time. Compound interest takes off only after a certain period.

So, the magic is not likely to reflect in short periods.

2. IMPACT OF WITHDRAWAL ON COMPOUNDING

What happens if you need money for something, and withdraw it from this kitty?

The positive impact ends at that point, and the cycle starts all over again. Now benefits are to be calculated from this new starting point. It is a fresh cycle.

How do you prevent this from happening?

Have separate funds for short-term and long-term goals. Always have an emergency fund, which prevents withdrawal from money reserved for other financial goals.

Ensure that you do not disturb the money reserved for a child’s higher education or retirement.

The same applies when you buy or sell direct equity in between, instead of holding it for the long-term.

3. ROLE OF DEBT

In some cases, you may borrow to meet an emergency, instead of withdrawing from a kitty for long-term goals.

Be aware that the interest charged on loans also attracts power of compounding. It may offset or negate the benefits you are trying to protect.

I came across this question on Quora.

Is it true that when you split a car loan into 4 weekly payments, instead of 1 time a month, it significantly drops the interest you pay on the loan and saves thousands in the end?

The rules in every bank or every country may not allow weekly payments. Lenders set an income target for themselves, and frame rules in line with it. They may have rules about which account will be credited first – principal or interest.

But the obvious benefit is that of reducing compound interest payment in the entire tenor of the loan. And can you not use it if you have accumulated credit card debt? Pay small amounts online, instead of waiting for the due date or demands from recovery agents.

You need to do a careful cost-benefit analysis of taking a loan vs. withdrawing from long-term investment.

4. HOW POWER OF COMPOUNDING WORKS IN MUTUAL FUNDS?

Relationship managers sell mutual funds by showing long-term compounding benefits, and claim to deliver returns as high as 15% p.a.

But your ultimate gain in a mutual fund is the difference between the buying price and selling price of units. Hence, the date of sale matters more than power of compounding.

The problem is that there are no fool-proof plans, because nobody can accurately predict the future. Long-term plans are guesses, and one should be happy if you hit the target on a large part of your goals. 100% success rate is too much to expect.

Related post: When Financial Advice stops making sense

HOW TO USE POWER OF COMPOUNDING?

- Let money age. Have a rule about spending it after a time gap on receipt.

- Start saving early for a long-term goal

- Allocate small monthly amounts to this goal, so you don’t need to withdraw it.

- Manage other financial goals from separate funds. Use increase in income to fulfil those.