Real estate excites people because it is a visible indicator of prosperity, unlike the paper or electronic assets that one owns.

You grow up with stories about how property prices appreciate multi-fold over a period of time. Figures are mentioned in absolute terms. The storytellers don’t talk about

- Annual rate of return on investment

- Comparative rate of return with other assets like equity or gold

- Age at which the investment is made

The total amount invested in real estate should be 20%-25% of your net worth, if we go by thumb rules. We will examine this further.

Let me introduce a term –

BINGE-ING ON FINANCIAL ASSETS

Investors block huge amounts in a single financial asset, because they believe it will deliver value in the long or short run, and the profits they make will outweigh returns on other assets. They ignore the principle of diversification or risk-return analysis.

It is not very different from gambling on larger amounts, when one is on a winning spree.

People may do it with real estate investments, direct equity or cryptocurrency.

Asset allocation is not the be-all and end-all of financial planning.

- Asset allocation is about allocation of certain amounts to financial goals. Loosely held wealth not aligned to money goals is a luxury of the uber-rich.

- And the financial instruments chosen to carry these do matter.

- The percentage of net worth blocked in each instrument matters. This percentage keeps changing as the value of assets appreciates or depreciates, and the total net worth changes.

- The time horizon needed for the assets to grow matters. As one grows older, the time available for multiplication is less. Long-term goals have now changed to short-term goals. A safe, fixed income becomes more important than long-term returns fraught with risk.

Broadly, risk should be reduced in a planned manner as one advances in age.

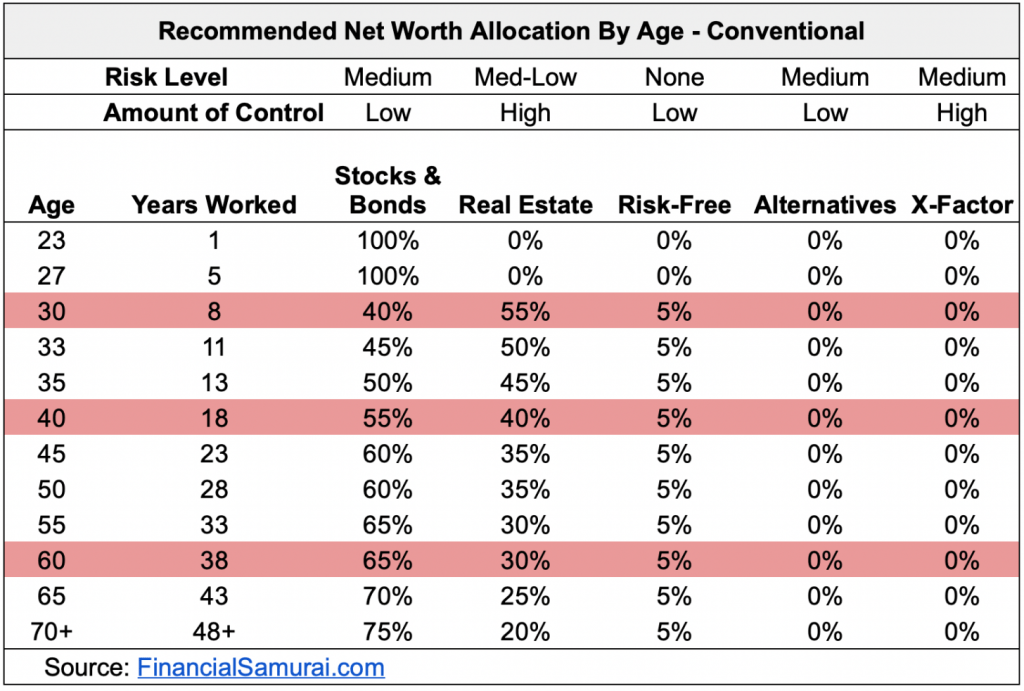

See the recommended net worth allocation at different stages of life, given by Financial Samurai in 2022.

Related post: Net Worth Allocation By Age and Work Experience

REAL ESTATE CAN MAKE YOU RICH, IF…

- You are in your twenties or thirties

- The investor can afford to block money for long periods of time

- You invest in commercial property with a pre-determined plan of letting it out to companies.

- The house is designed to facilitate renting out rooms on AirBnB or similar schemes.

- The property is located where there is a demand for short-term rental accommodation by students or singles.

- It makes sense if a property is linked to a financial goal, and can be sold at the right time.

- You may opt to invest in Real Estate Investment Trusts (REITs), or real estate ETF (exchange-traded funds) to encash on short-term booms in real estate markets.

REAL ESTATE CAN BE A POOR INVESTMENT, IF

You fail to take all costs into consideration

- The major components of cost are stamp duty, registration charges, home insurance, home loan protection insurance, maintenance charges, property tax.

- If you buy a property for its rental value, gaps in rental yield will decrease overall calculated returns, while you continue to incur the costs.

You borrow at a high rate for a second or third property

- If you avail of a home loan for an apartment booked in a residential project, then a delay in delivery will mean a higher pre-EMI interest paid by you.

- Black Swan events can happen any time. The consequent failure to pay EMIs in time leads to increased interest costs, with an extension of the loan tenor.

- The interest you pay is more than the tax you save.

- You may borrow at a low rate, but a floating rate can increase in the long run, thus, inflating EMIs.

- If you opt for pre-closure of the loan or sell the property, you find a large portion of principal unpaid. It is due to the fact, that banks recover more interest in the initial years than principal.

You divert resources from other financial goals

Real estate courses or real estate companies do not take into account your overall financial planning and liquidity needs.

What happens when you urgently need money for unforeseen circumstances? Is it simpler to liquidate bank deposits or stock market investments, or to sell a property?

You invest, but fail to examine avenues for leveraging on assets before that.

- Reverse mortgage looks like a good option for old couples, but has too many terms and conditions, and the annuity amount is low. There are very few banks offering the product.

- Loan on property needs to be repaid, and it will eat into your fixed post-retirement monthly income

You are above 50 years of age

- If real estate appreciates in a span of 15-20 years, will it help when you need liquid cash?

- If you decide to consume 3%-4% of your principal amount every year, you cannot break real estate into units. You will need to liquidate the property, pay capital gains tax and invest the money elsewhere.