The formula for net worth calculation appears to be a no-brainer.

Net Worth = Total Assets – Total Liabilities

When you buy an asset, the cash account is debited and asset account credited.

If you sell an asset, the cash account is credited and asset account debited.

Overall, it does not affect the total net worth.

However, one often tends to overlook certain intricacies in calculation.

You may also have a lot of questions in mind.

Does it largely remain the same or change with time?

Can it change with age?

Is it possible for net worth to be negative or zero?

What is the link between income, expenditure, assets and liabilities?

Most important of all, what are the common mistakes that occur in calculation?

HOW IS NET WORTH CALCULATED?

Total Assets

Your cash in hand, bank balance, stocks held, gold & silver, possessions like real estate, car, expensive art all add up to your assets.

Total Liabilities

Outstanding balances in your loan accounts, credit card debt, unpaid tax liability and any amount that you owe another person/ institution add up to your liabilities.

The difference between the two is your net worth, as indicated in the formula above.

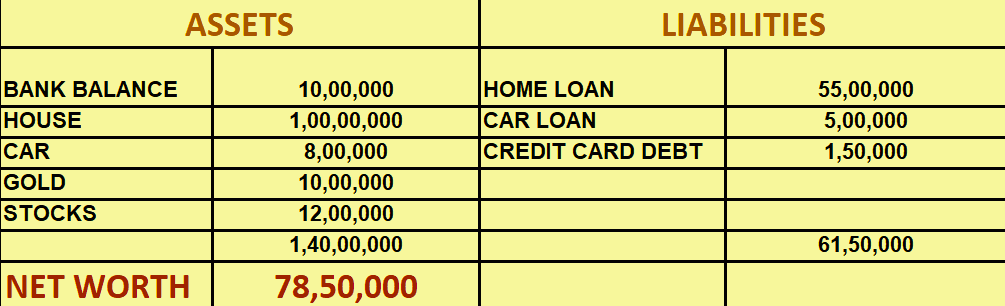

Here is an example to clarify the formula.

CAN NET WORTH BE NEGATIVE?

If the liabilities outweigh the assets, yes, net worth can be negative.

IS NET WORTH EQUAL TO YOUR INCOME?

No.

It is related to your total income, but it is not the same. What really matters are your savings and investments. It is about what is left over after deducting expenditure from your income.

COMMON MISTAKES IN CALCULATION OF NET WORTH

Have you taken into account the following?

1. GUARANTEES GIVEN ON LOANS

If you stand as a guarantor to the loan of a friend, family member or business associate, the amount of loan is counted as your liability.

You may end up paying that amount, if the borrower fails to repay the loan.

2. FUTURE TAX LIABILITIES

You take into account the present market value of your house or stocks. But what will be the tax liability in case of redemption or liquidation of the asset?

If you gift an asset to a family member, do they need to pay gift tax, which effectively reduces the value of the asset on the receiver’s books?

3. ACCOUNTING OF JOINTLY HELD ASSETS

If you are the co-owner of a house with your spouse, and a co-borrower in the home loan, you need to split the value of the house, as well as your loan liability while calculating individual net worth.

4. TANGIBLE NET WORTH

If you are an artist or author holding intellectual property rights, copyrights, patents, your tangible net worth needs to be calculated separately.

This is just the dollar or rupee value of all your assets minus all your debt.

Tangible net worth = Total Assets – Total Liabilities – Intangible Assets

HOW DOES NET WORTH CHANGE WITH AGE?

Alan’s first employer asked him to submit a statement of personal assets at the end of every financial year, in a closed envelope. It was a time to take stock, and Alan was pleased to see the number of items he owned go up every year. He has married Marianne recently and both are setting up house.

Their first big purchase is their dream car, and then a small apartment in a prime locality. Alan is repaying an education loan, and Marianne’s income is needed to run the household. They also charged expenses on a holiday to their credit card.

Alan’s employer asks for an asset statement, because he works in a bank. They refer to these statements if they suspect an employee is involved in fraudulent activity or corruption. Alan misses the point that the statement format does not include liabilities, and that his assets are not his net worth.

The couple has borrowed heavily, and at this point of time, the liabilities outweigh the assets.

They have a negative net worth.

But is this an alarming situation?

No.

The liabilities in early stages of life are usually higher than mature years.

The comparison, if any, needs to be with people in your age group with a similar income level.

The net worth changes with age, as your liabilities decrease and the market value of assets go up. We say this on the assumption that you are not living in recessionary times, when asset value drops.

WHY CALCULATE NET WORTH EVERY YEAR?

Doing a review every year gives you an idea of the direction you are moving in. You need to know if the movement is aligned to your financial goals.

It helps in the following ways.

1. DEBT MANAGEMENT

If the liabilities are high, you need to think about balance transfers, settlement of debt or restructuring of assets to reduce the total interest outgo in the long run. It ensures that your net worth remains on an upward trend, leading to financial wellness.

2. MARKET FLUCTUATIONS

The value of your stock portfolio can fluctuate every year. What you buy and sell, and how value of stocks in your portfolio makes a difference.

It is not linked to stock market indices. It is just about how your portfolio has performed.

3. DEPRECIATION

The value of your vehicles depreciates every year.

The outstanding balance on the vehicle loan (if you have one) may change in a different manner.

The financial statements change accordingly.

4. RISK MANAGEMENT

If the risk is high, you need to rebalance your portfolio or restructure investments.

You also need to take sufficient insurance to cover risk.

Examples

- If a business person has huge liabilities, it may make sense to buy a life insurance policy with the Married Women’s Property Act clause. The MWPA clause protects the proceeds of the policy from debtors, in case of the husband’s demise.

- If the home loan appears to cripple all financial decisions, you may want to go in for a home loan protection policy.

HOW NET WORTH INCREASES?

It increases with

- an increase in value of assets you own

- addition to the assets you own

- decrease in liabilities