Stock investments have taken a beating. It is a moment, which will pass.

Yet, we are plagued by uncertainty and decrease in net worth. It is human. It’s very natural. We do not like seeing a downward turn in graphs, especially those related to our life and happiness.

It leads us to the question, “How much is too much for stock investments?”

Related post: Real Estate can be a poor investment, if…

THUMB RULE FOR STOCK INVESTMENTS

Thumb rules tell us the percentage of stock investments in our portfolio should be 100 minus your age. Some enthusiasts extend the base number to 110.

It means if your age is 40, the percentage of stock investments in your portfolio should not be more than 60%-70%.

What is the logic behind this thumb rule?

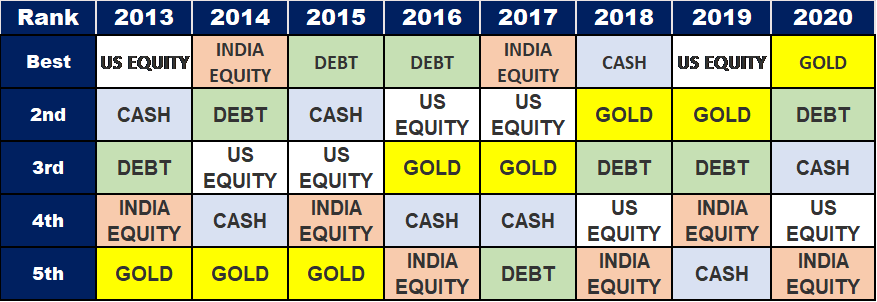

The younger you are, higher is your risk appetite and risk bearing capacity. And it is rare that two asset classes see a downturn at the same time.

Yet, risk is also subjective. The perception differs from person to person. A paraglider may see the world at his feet, or an ocean waiting to swallow him.

DIVERSIFICATION OF PORTFOLIO

It is not putting all your eggs in the same basket. If the returns on one investment suffer, there is something else to balance it. That’s sound logic, isn’t it?

Diversification is about different asset classes in your portfolio. It is also about investment in companies and industries within a stock market portfolio. Each new stock added should reduce the overall risk.

Diversification in mutual funds is spreading your risk over Exchange-Traded Funds, Real Estate Investment Trusts, sectoral mutual funds and index funds. But take care to see that these funds are not invested in the same companies.

Can one over-diversify?

It happens when new additions reduce overall returns, without a corresponding decrease in overall risk. It makes sense to identify 10-15 good stocks from different segments and stick to those.

WHAT IS OVERLOADING IN STOCK INVESTMENTS?

Overloading can happen in the following scenarios.

1. EMPLOYEE STOCK OPTIONS

You have ESOPs because you have earned those. And if those are performing well in the market, there appears to be no reason why should it not be a dominant part of your portfolio.

Yet, we need to check the percentage of it in our total portfolio. Is the growth in your portfolio only due to this one stock? A dip can wipe away your net worth.

There is no harm in selling some to buy other equally good stocks.

2. EMULATING A FRIEND’S STOCK INVESTMENT PATTERNS

Advice is more easily available than returns in stock markets. Each piece of advice reflects the experience of a single investor or group. We tend to buy the story without comparing the time period and market trends.

Certain stock tips are circulated only to boost demand and increase the prices of a company share. And by hook or crook, we divert resources which could have yielded a higher value somewhere else.

Ultimately, gains in direct equity or mutual funds are the price differential between the buying price and selling price. This depends on the point of time you choose to buy or sell, so it cannot be the same in any two cases. All the content we consume is generalized, not specific to your circumstances.

Investment needs to be tailored to your financial goals and time horizons, not an impulse or friendly advice.

3. IGNORING TIME HORIZONS IN INVESTMENTS

Mutual funds yield value in the long run.

It will be a mistake to block funds which are needed for a short-term financial goal. You miss out on the compounding effect of an investment, or face a liquidity crunch when cash is needed.

4. NOT KNOWING YOUR RISK BEARING CAPACITY

Risk bearing capacity is different from risk appetite. People want to jump in on the newest fad that all investing apps are talking about. They pump in a lot of cash in the lure of quick profits. The total amount blocked may not be in line with their risk-bearing capacity, stage of life and financial goals.

If at all, you have jumped into this, it is important that one books profits at the right time. The fad may turn into a bummer in a short while.

“When you work on something that only has the capacity to make you 5 dollars, it does not matter how much harder you work – the most you will make is 5 dollars.”

― idowu koyenikan, Wealth for All: Living a Life of Success at the Edge of Your Ability

5. NOT DOING A PERIODIC PORTFOLIO REVIEW

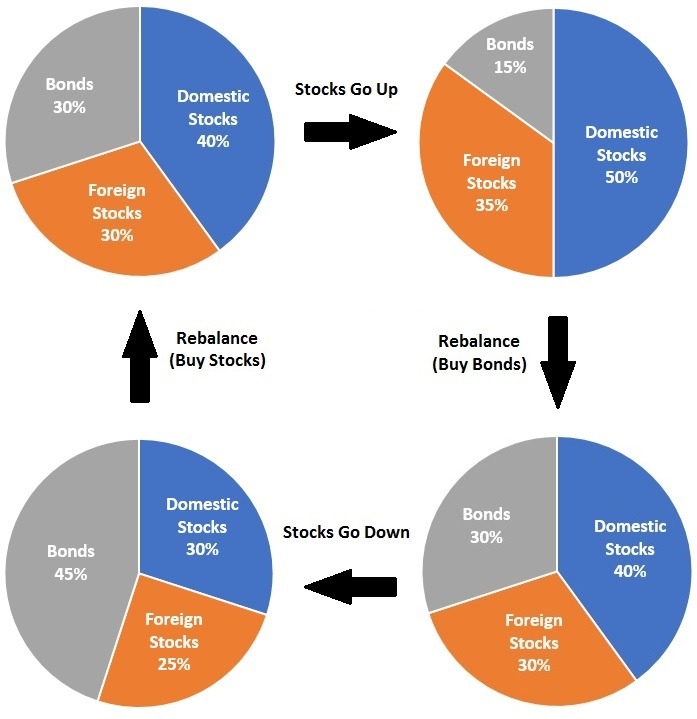

All assets do not grow at the same rate. You may have withdrawn funds from somewhere or invested more.

It alters the percentage of assets in your portfolio.

If you find any one asset class overloaded, rebalancing is the best option.

Can one plan for a stock market downturn?

Or, be ready for a churn.