Tax planning for salaried employees calls for attention in the month of December, as employers mount pressure to submit proof of investments made for tax exemption.

A favourite rant of financial planners is that investments are made to save taxes, whereas they need to be goal-based. Is there a way to balance the two aspects?

Millennials have many more options and access to information which was not available to their parents. They are also exposed to new age temptations which promise high returns in a short time. They give in to nudges from apps without keeping the total picture in view.

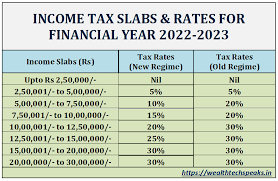

INCOME TAX RATES

Starters can choose between two income tax options – a lower tax rate if they do not seek exemptions, and a slightly higher one if they choose to invest money and save taxes. Needless to say, those who are already invested in long-term plans will stay with the second option.

However, if funds available for investment are limited, one needs to balance the following aspects.

- Tax exemption

- Financial goals

- Inflation adjustment

- Risk management

How many financial goals can one fulfil in the process of investing for tax exemption?

1. RISK MANAGEMENT

Let’s examine the risk aspect first. An emergency can wipe out your savings reserved for other financial goals. And what is more likely to hit at your age? Financial goals below 30 are different and tax planning options are more flexible.

If there are no dependents, life insurance is not on top priority despite all arguments in favor of a term plan to be taken early in life. One can always opt for it later.

Health insurance matters more, given the high cost of medical treatment.

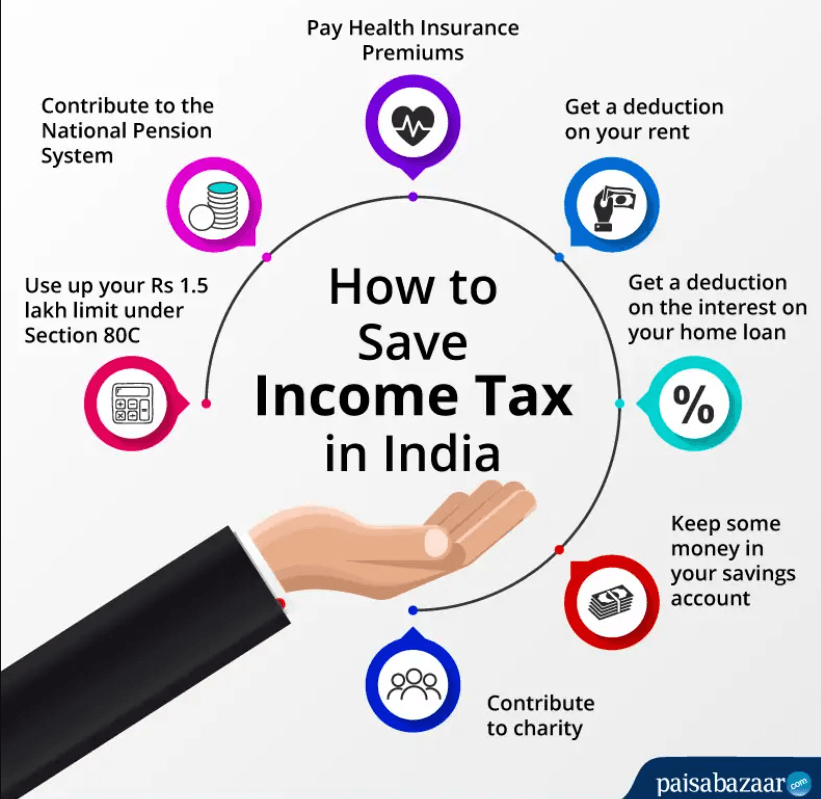

Section 80D comes to your aid. You can claim tax exemption for annual premium on health insurance paid up to Rs. 25000/-, if you are between 18-60 years of age. You can claim additional exemption up to Rs. 50000/- if you buy health insurance for parents who are more than 60 years of age.

Employers do provide group health insurance, but terms and conditions change for every plan and company. A lady decided to forego a new job offer because her mother-in-law needed an urgent surgery, and the next company did not provide health insurance cover to parents and in-laws. It makes sense to have an additional cover for health. You may choose riders and critical illnesses which are not covered in the employer’s plan. Or just increase the total amount of protection available. Healthcare in emergencies gets expensive by the day.

You can tick one financial goal on protection against health risks to you and your family, along with good tax planning.

2. RETIREMENT PLANNING

You have provident fund where the employer pays an equal share up to 12%. You can opt for voluntary provident fund over and above 12%, and save tax for own contribution up to Rs. 2.5 lakhs p.a. (inclusive of both EPF and VPF).

Employers in the private sector do not provide pension benefits. The government is also looking at ways to reduce the load of pension payments on the exchequer.

The National Pension Scheme is a voluntary retirement savings scheme, where citizens in the age group 18-70 years can choose their own plan.

Investment in NPS – Tier I up to 10% of gross income is exempt from income tax. One has the option to choose from the following asset classes, under the active option.

- Asset class E – Equity and related instruments

- Asset class C – Corporate debt and related instruments

- Asset class G – Government Bonds and related instruments

- Asset Class A – Alternative Investment Funds including instruments like CMBS, MBS, REITS, AIFs, Invlts etc.

One can switch between different options as per prevailing market conditions.

In the auto-option, funds are invested as per age and risk profile of the individual.

Tier 2 scheme is an optional savings scheme, which does not qualify for tax exemption. Funds are however withdrawable at will, unlike the Tier 1 option.

NPS is the cheapest pension fund with low administration charges.

3. GROWTH AND RETURNS

ELSS MUTUAL FUNDS

ELSS (Equity-Linked Savings Schemes) Mutual Funds have the lowest lock-in period (3 years) compared to other tax-saving investments, and get market-related returns.

The first tax-saver index fund in India is launched by IIFL. The New Fund Offer for IIFL ELSS Nifty 50 Tax Saver Index Fund will remain open from December 1, 2022 to December 21, 2022.

It helps you grow money in the stock market, while you tick another box for good tax planning.

HOW GOOD ARE CRYPTOCURRENCY INVESTMENTS?

Profit earned from investment in virtual digital assets attracts 30% income tax, irrespective of the income tax slab you are in. Capital gains cannot be offset against losses in other stock investments.

Ensure that the tax savings accomplished through other investments does not get neutralized by crypto-investments.