Loans without documents are unthinkable for a professional banker. Yet, the word jumps out of several screens to spark my interest.

DEBT RECOVERY CALLS

The first trigger comes out-of-the-blue from a persistent caller, while I’m conducting a training program for debt recovery agents. I excuse myself and go on Mute to attend the call and tell her I’m busy. The caller is abusive and says “If someone calls, you better talk.”

The screen flashes the same number again, and she is adamant that I should not disconnect.

“I’m calling from —- Finance. Aren’t you AC’s mother?”

“No. I’m Reena Saxena, and you might as well not disturb me again. My number is on DND (Do Not Disturb), which most of you do not respect.”

The caller and phone are both stunned into silence.

I take the opportunity to tell the trainees how recovery calls should not be done.

“Always confirm who you are speaking to, and don’t make bunched calls. This caller is obviously not a certified debt recovery agent.”

SOCIAL MEDIA POSTS OFFERING LOANS WITHOUT DOCUMENTS

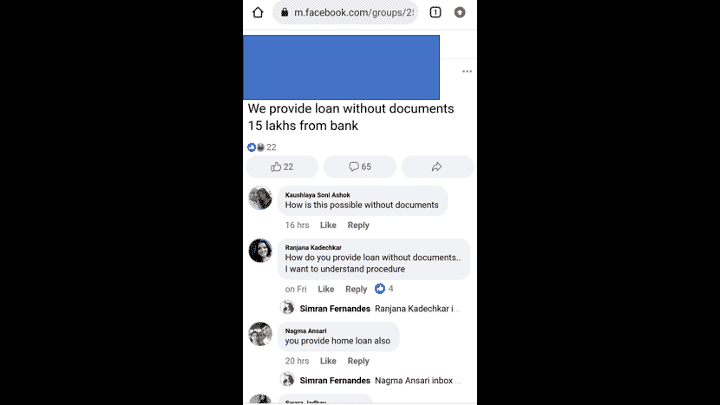

After a long and tiring week, I start scrolling down the Facebook feed, and come across this post.

Someone is soliciting applications for a loan without documents from a bank, but not disclosing details on the post. Those who are interested need to inbox her.

All that I’ve been reading about illegal lending apps sufficiently piques my interest to investigate the matter further.

There are many ads talking about

- instant loans without documents online

- easy instant loan without documents

- personal loan no documents needed

- how to get a loan without proof of income

- paperless loans

and so on. Some of them promise approval within 3 minutes or more.

PAPERLESS LOANS ARE NOT LOANS WITHOUT DOCUMENTS

Paperless loans ask for documents to be uploaded online, and loans are approved after due verification. Some banks may opt for this process.

It just means the lender works with soft copies of documents, and you don’t need to visit their office or meet their relationship manager.

COLLATERAL-FREE LOANS

The loans being offered in this manner are unsecured personal loans. It means you can get a loan without mortgaging, hypothecating or pledging a financial asset to the lender.

Your repaying capacity (monthly take-home pay) determines your eligibility for the loan. Personal loans are offered to business persons based on their income tax returns and bank statements.

The word ‘documents’ often gets interpreted as papers supporting your ownership of an asset to be pawned. So, a seeker of quick money gets misled.

In this case, you do need to submit KYC documents, PAN and proof of income. The lender will check your credit score online.

PERSONAL LOANS WITHOUT DOCUMENTS

I found some NBFCs and lending apps using this language in their promotional material. However, no documents means ‘minimal documents’, which may include a PAN or Aadhar. ‘Loans Without documents’ is a clickbait.

A justifying statement in one of these ads says’ most of your information is available online’.

Yes, a PAN or Aadhar number can lead to your credit score. Your personal information may be available on social media profiles, which can be verified.

Some of them offer a scheduled pickup of documents (attested photocopies of required documents), and insist on a minimum credit score.

RATE OF INTEREST AND CHARGES

The rate of interest charged is in the range of 1.5%- 2.25% p.m. or more. It means that you pay interest on a loan for a maximum period of 3 years at 18% – 27% p.a.

A loan of Rs. 1,00,000/- for a period of 3 years at 2.25% p.a. will cost you Rs.81000/- as interest plus charges. Compounding of interest may take the interest amount beyond the principal.

Lending apps may charge more than this rate, and calculate interest on a % per day basis.

Processing and other charges apply, which increase the cost of the ‘loan without documents.’

“Higher the risk, higher the rate of interest” is a lending principle. This is what NBFCs encash when they lend to individuals with a credit score less than 750 (it is usually a range of 600-750). These are the people in need with no access to bank loans owing to a low credit score.

METHODS OF DEBT RECOVERY

Refer back to the conversation I had with a recovery agent, when I’ve never applied for or taken a loan. Note the language “Aren’t you AC’s mother?” It means your family members are not spared from harassment, and there is no confidentiality of data. They start talking about the loan without verifying whom they are talking to.

If you recall the suicides of borrowers from lending apps in Telangana after threats of exposure in their social circle, you can imagine the kind of unprofessional recovery methods used.

LENDERS APPROVED BY RBI

Anybody who lends should have a bank or NBFC licence from RBI.

Find the list of approved NBFCs on the RBI site here

Lending apps have tied up with a bank or NBFC, and a borrower should know who the actual lender is, and whether it is approved or not.

A recent report showed that 600 illegal apps are still operating in India, and are available on 81 app stores.

RISKS INVOLVED IN USING LENDING APPS

When you download an app, they ask for umpteen permissions to access data on your phone, including some dangerous ones such as changing your Contacts. They gain access to your Contacts, and then threaten to defame you.

When you upload documents on an unknown site, you stand the risk of your documents being mis-utilised for a fraudulent purpose.

You may click on a box asking you to accept terms and conditions, without knowing what those terms and conditions are. You need to ‘Accept’ it to move ahead on the site, and you’ve now entered a contract without knowing or understanding its contents.

HOW DO YOU LODGE A COMPLAINT AGAINST FRAUDULENT ENTITIES?

If you are the unfortunate victim of a fraudulent operation, or know someone who is in that space, you may lodge a complaint on

Stay alert, stay safe! Do not fall victim to temptations of easy money. It becomes more difficult than the difficulty you may be facing due to lack of funds.

Related post