July is a high point in the financial life of employees and other taxpayers. It’s time to file income tax returns. And after two years, we are back to the original date of filing- July 31. Hopefully, no extensions will be needed.

What are the new elements in this annual financial compliance ritual in 2022?

And what are the resources you can access to ease the process?

INCOME TAX ON WEB3 INVESTMENTS

The announcement of 30% income tax on capital gains in Web3 investments (cryptocurrency, NFTs, virtual digital assets are other terms) shook up the crypto-investor community a few months ago. 30% rate is applicable to all VDA investors, irrespective of the tax slab they fall in. And to exacerbate it further, capital gains in virtual digital assets cannot be adjusted against losses in other investments.

How does an investor in cryptocurrency or virtual digital assets calculate income tax payable?

A start-up KoinX comes to your rescue. They are integrated with platforms like WazirX, CoinDCX, Binance, Wauld, Coinswitch Kuner. You need to download your reports from the platforms, exchanges and wallets you use for investment, and upload the files on KoinX. The site gives you a downloadable tax report.

They have acquired Crypto-Kanoon, a Web3 legal awareness platform, and possess requisite expertise in legal aspects.

INCOME TAX ON CONTRIBUTION TO VOLUNTARY PROVIDENT FUND

The interest on PF contribution above Rs. 2.5 lakhs will be taxable, w.e.f. 1st April, 2021.

If your basic salary is up to Rs. 1.73 lakhs in a month, and the provident fund contribution is Rs.20,833/- or less, you don’t have to pay income tax on this item. This tax-free element does not include employer’s contribution.

In case you are fortunate enough to be in a higher income bracket, this is how your income tax will be calculated.

This calculation from Bemoneyaware makes it super easy to understand.

CAN YOU REALLY PAY ZERO INCOME TAX ON INCOME MORE THAN 10 LAKHS?

Yes, I came across articles with this click-bait headline.

Let’s dive a bit deeper and see what is applicable to you. Investments need to be in line with your short-term and long-term financial goals, other than helping you save tax. Eligibility and the rate of return also matters.

One should invest about 20% of annual income in eligible instruments. The percentage is in line with the 50:30:20 thumb rule (Fixed cost – 50%, Discretionary cost – 30% and saving 20%).

But how and why?

Let’s examine the exemptions available to you.

Investments under Section 80C

Have a cute daughter below the age of 10 years? You are eligible to invest in Sukanya Samriddhi Yojana at 7.6% p.a.

Amount remains blocked till she turns 21.

Decide how much would you like to contribute towards this goal in a year, up to a maximum of Rs. 1.5 lakhs

Are you a senior citizen? Invest in Senior Citizens’ Savings Schemes with a return of 7.4% p.a. The maximum limit is Rs. 15 lakhs.

Are you a senior citizen with parents who need health insurance? Pay a premium of Rs. 50,000/- to gain tax exemption.

Do you have a home loan going? Interest up to Rs. 2 lakhs p.a. is exempt from tax. But it may not be good financial sense to buy a house with a home loan, only to save income tax. It may not be in line with your long-term financial goals. Maybe, the amount you pay as interest serves some other purpose better, and gives you more liquidity.

An article advises that you donate Rs.25000/- to a charitable institution only to hit the zero-income tax number. Think again. Do you really want to?

Tax-saver FDs fetch you returns in the range of 5.3% to 6.25% p.a., and block funds for 5 years. The period of investment is same for National Savings Certificate which offer a return of 6.8% p.a.

Earn 7.1% pa on Public Provident Fund and invest for retirement goals. The lock-in period is 15 years.

All families should have health insurance with a premium of Rs.25000/- or more on their agenda.

The point is that you need to choose investments suited to financial goals, other than saving tax. Look for a period and rate of return suited to those.

Do not dry out liquidity in a quest for high returns. Plan it instead.

Check your financial quotient here.

Investment in National Pension Scheme

An additional investment in NPS, other than Section 80C is also tax exempt.

Do opt for this if you can, for retirement goals.

DIY INCOME TAX CALCULATION

There are many sites which offer income tax calculators. You may stick to your favourites.

Have a look at apnaplan, which gives you a downloadable calculator.

Then comes the oft-repeated question – Why is income tax high in India?

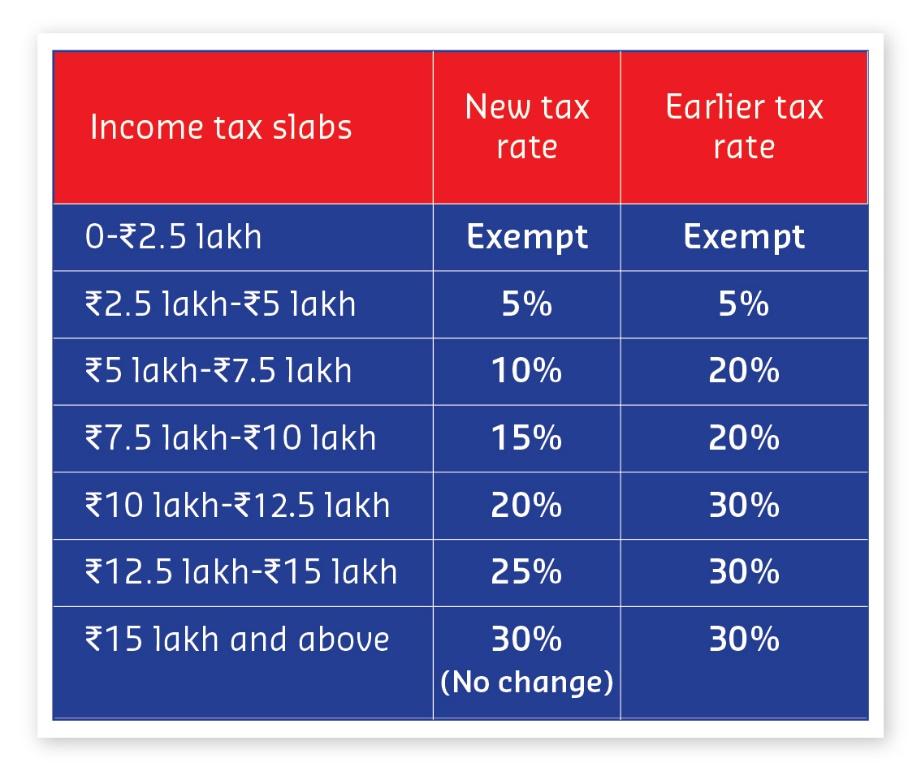

You do have an option to choose the new tax scheme with lower tax rates. There is no option for claiming exemptions for investments here, but rates are low for people with an annual income less than Rs. 15 lakhs.

GENERAL DOCUMENTS NEEDED TO FILE INCOME TAX RETURNS

- PAN

- Aadhar

- Form 16

- TDS Certificates – Form 16, 16A, 26AS

- Bank statements

- Salary certificates

- Tax payment challans

- Investment proof

- Receipts of donations made