Emotional intelligence is a term coined by Daniele Goleman, and he paved the way for recognition of different forms of intelligence – like spiritual, social, financial. Many others keep emerging, as different segments of the population flaunt their capabilities.

Do you know how many individuals reside within one human body? When we say we do not understand a particular person, we are unable to relate to the many facets of an individual. We do not know which side will emerge at a particular moment.

We set goals enthusiastically, but are unable to stay committed to a line of action to achieve it. It happens because different sides of our personality take over at different points, while the goal-setting is done by one of them.

EMOTIONAL INTELLIGENCE IN BUILDING METAPHORS OR STORIES

Ask your friends and family how they visualize their role in the world. You may hear terms like lighthouse, pathway, facilitator, motivator, knowledge-sharer or wealth creator.

Ask yourself the same question. It will show you the power of metaphor in defining yourself.

I came across some excellent advice on metaphor-building and storytelling. It listed out different approaches –

Chronology, logic, shocking facts, emotion, passion, utility to others.

Then it underlined one sentence

Emotion works 90% of the time, whether you believe in it or not.

EMOTIONAL INTELLIGENCE TO RECOGNIZE YOURSELF

Can you identify three predominant facets of your own personality?

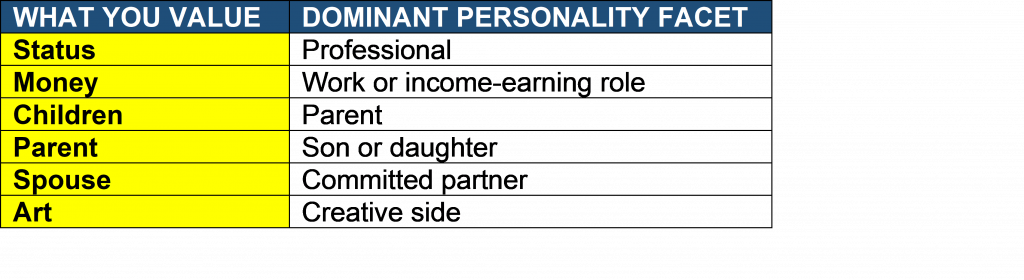

What do you value most in life?

Can you correlate the items on the left and right in the table below? Allocate a number in order of priority to items on left side of the table. It shows you the side which is predominant, and others which get active only when needed.

How can these different facets stick to an action plan to meet financial goals?

1. PROFESSIONAL

- Schedule meetings with your financial planner, stock broker, bank relationship manager, insurance advisor or chartered accountant in the office.

- If you are a DIY financial planner, do your online research in the office. Consult your colleagues or seniors about various plans.

- Utilize your lunch hour or coffee breaks in the pantry to do this.

You are likely to stay true to your commitment, because you are in an environment, where you want to be taken seriously. You will not like the colleague in the next cubicle or pantry or your secretary to know that you faltered on something.

2. WORK OR INCOME-EARNING ROLE

- Tie up your financial plans with the inflow of money.

- Pay your SIP instalment and credit card bill by auto-debit from your salary account. Park your emergency fund or the money you are saving for the down payment for your house in an account or wallet linked to your income account.

You remain aware of the need to earn more or save more to meet the commitments.

3. PARENT

Talk to your children about their dreams and ambitions. You don’t have to tell them, but save and invest in different pockets for goals related to them.

You can’t risk their future, so invest in different asset classes in line with the time horizons. Learn all about mutual funds, appreciation of real estate, direct equity, P2P lending, non-fungible tokens and cryptocurrency. Choose the options that feel safe.

In the long run you would have built up a diverse corpus of funds. Money does not have anybody’s name or goal written on it. The name you give it enhances visualization and motivation.

The funds will be available to you for different needs at different points of time.

4. DUTIFUL SON OR DAUGHTER

Think about what your parents need – health insurance, assisted care or a place to indulge in their hobbies.

Build it in small ways. Let them know and see their happiness.

Whatever your parents own will come back to you at a later stage.

5. COMMITTED PARTNER

You like to ensure financial independence for your spouse, in your presence or absence. You don’t want to see your partner asking for help or living a sub-standard life.

Build that future. You may share it together at some point of time.

- Open joint accounts with the Former or Survivor mode of operation. You retain control as long as you are alive. If you happen to depart, the chosen joint account-holder becomes owner of the funds, not a legal heir.

- Ask for the Married Women’s Property Act Clause while buying an insurance policy. Debt will not destroy your peace, if you insure the financial future of your wife.

- Buy term insurance plans to protect your home loan, instead of Home Loan Protection Plan with reducing cover.

6. CREATIVE SIDE

Discover methods of monetising your creativity. You can build up another stream of income, even if it is small.

It will serve as a fall back in case the main source of income falters. It will also aid psychological well-being in your golden years.

KNOW THE DOWNSIDE OF BEING SEEN AS EMOTIONAL

I can hear loud whispers from people who had a bad experience.

Parents can take from one child, and give it to another. Children can squeeze you to the last penny with manipulation or aggression. Your relationship may end in a divorce, where sharing of resources is discussed in a courtroom. Job roles end sooner than expected.

Yes. It has happened, and it can happen again. Maybe to you. We cannot rule out adversity or disappointment.

The idea is to never hand over control of your assets, while you are alive.

TOOLS

- Write a will for your present net worth. Keep revising it at short intervals. Nomination is essential, but not enough. The succession laws take precedence over nomination, and your nominee will be compelled to transfer assets to the legal heirs.

- Master technology so that you don’t depend on others for financial transactions. YouTube and websites of financial institutions store a lot of information.

- Do not share passwords freely or give access to your accounts. But store the information in a file, and let one trusted person know where to look for it.

- Do not invest in an asset you don’t understand, just because a loved one wants you to do so.

- Do not give away all details of your assets. Leave certain things to the imagination of others. It will ensure you are valued as long as you live.

Visit Money Habits to know more