Millennials and money management is a favorite topic for sellers of new age products and parents alike. We often lambast the millennial money mindset as being irresponsible or myopic. Yet, surveys show that the situation on ground is not so dark.

Yes, they are driven by technology. It exposes them to the risk of induced behavioral and debt traps.

Let us bring out the positives first.

MILLENNIALS AND SAVING MONEY

Statistics show that they save 10%-12% of their income, which is low given the fact that retired life may be 30 years or longer.

Savings are inversely proportional to spending. A Live Mint report of 2019 shows that the millennials spend more on gadgets and technology compared to baby boomers. But why ignore the fact that they’ve grown up with these items around? Air conditioners are essential items rather than being the comfort or luxury these gadgets were for their parents. None of us can survive without devices or connectivity. Let’s accept that it’s only a matter of choosing an appropriate price range.

What they need to focus on is developing multiple sources of income, as a buffer against the roller-coaster economy.

HOW SHOULD MILLENNIALS INVEST MONEY?

It is true that they do not think long term. We may attribute it to the fact that they live in a fast-changing world, where nothing is taken for granted.

Is Goal-based investing a thing of the past, since goalposts keep moving?

Instead, they can invest in schemes designed for a particular time period and rate of return. Let’s say they invest certain sums for 5 years, 10 years and 20 years. The chosen asset classes, level of risk and ease of liquidity may differ. In this manner, they can ensure that money is available for whatever purpose they need it, at the right time.

Let’s not label funds and make it an emotional issue. Money is money and should fulfil a valid need. We are not talking about impulsive spending here, which can harm a future financial goal.

Money apps will remain on the scene. It’s just that one needs to exercise caution about safety and not getting carried away with the nudges to buy certain financial products. Businesses design apps to influence money mindsets, and sell products to the target audience.

AVOIDING THE DEBT TRAP

Americans live on credit. They focus more on good weekends, rather than long-term financial goals.

The Indian baby boomer mindset is different with a focus on real estate and gold. They restrict lavish spending to special occasions in the family. I learnt this from the money management system of a Marwari business family. The head of the family easily spares money for jewelry, since display in weddings is a status symbol. But he prefers spending on metal rather than gemstones, with an eye on long-term appreciation in value.

Gone are those days, and millennials spread expenses over a diverse set of products and services. Global markets actively target Indian youth with products that induce habits of living on credit. Popular examples are Buy Now Pay Later schemes and credit card challengers to woo new to credit users.

However, personal loan data given by Simply Cash in 2021 shows a different picture.

This shows borrowing is not as frivolous as it’s made out to be. Maybe this is the Covid impact, but let’s hope the trend continues. Maybe, we can trust millennials with money matters.

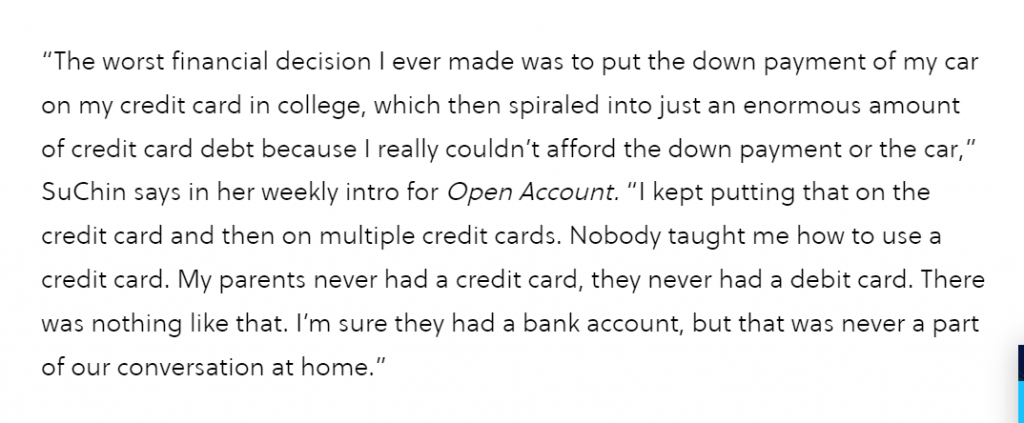

Su Chin, an American influencer talks about her greatest borrowing mistake here.

We cannot over-emphasize the importance of financial literacy for teenagers and new entrants to the workforce. Let millennials and money management not be a topic of concern in future, but something we take pride in.

Related post – Financial Planning for Millennials