Do you think you need a guide or workbook for retirement planning, which can be copy-pasted on your financial plan?

It is just an effort to build the right mindset, and stop taking certain things for granted.

NOT ALL SENIOR CITIZENS ARE RETIRED & VICE VERSA

The legal definition of a senior citizen is one who has attained 60 years of age. It is the senior citizen age in India. Residents of other countries need to think how and what is a senior citizen defined in their country of residence.

Since 60 happens to be the retirement age in most Indian organisations, the terms ‘retired’ and ‘senior citizen’ are sometimes treated as synonymous.

It is true that one starts getting certain concessions in travel, higher interest rates on fixed deposits and some other benefits at the age of 60. However, it does not imply that all those who attain the age of 60 have stopped working, or earning money.

For the sake of this article, we will assume that ‘work’ is ‘paid work’, and not volunteering or indulging in hobbies. People continue in business, sign new contracts with the same organisation, take up advisory or board member roles or start moonlighting. They are in a position to encash expertise.

At times, paid work stops at an age below 60. It may be a sabbatical, unemployment, restarting in a new role. Whatever the cause, a cash reserve is needed for sustenance.

UNDERESTIMATING IMPACT OF SABBATICALS

Sabbaticals are romantic. Sabbaticals are the latest fad.

Sabbaticals can be voluntary or imposed.

Sabbaticals can happen at any age – at the prime of your career, or close to retirement.

Sabbaticals have the potential to throw your financial plans out of gear, as you are only spending in that phase, not saving or investing.

You lose the benefits of compounding, when you draw money from a long-term nest egg for sustenance. Assumptions made in the spreadsheets for retirement planning will change, and so will the inserted formulae.

You need to revise your retirement planning worksheet, depending on what kind of retirement funds you plan to retain or consume.

RETIREMENT PLANS NEED TO BE FLEXIBLE

One needs to work on at least three options –

- If you retire at 60

- If you retire before 60

- If you retire at 65 or 70

You need to include your family in your plans, without giving away exact details and passwords. Take this free course on Money Management without Mindset to understand the logic.

RETIREMENT PLANS NEED TO PROVIDE FOR 30 YEARS

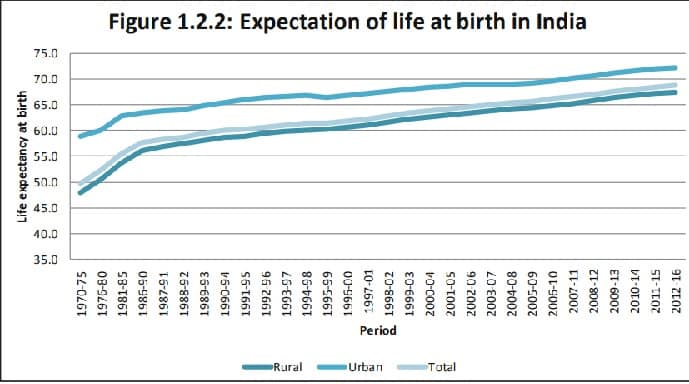

Statistics speak of an average age expectancy of 69-70 years in India.

Averages do not always speak the truth. Many of us are caregivers to parents and grandparents above 80 years of age.

American financial planners make financial plans, assuming that a person will live till the age of 99.

Neither is the age of retirement certain, nor life expectancy. One can assume sustenance for 30 years to facilitate a plan.

Meanwhile, the stock markets, real estate prices and interest rates will all fluctuate. So, let’s accept that plans need to be flexible.

Here is a video for those who understand Hindi to emphasise the importance of earning money (if possible) in your golden years.

OVERESTIMATING RETURNS ON INVESTMENT

We often go by the projection charts and retirement planning worksheets shown to us by the relationship manager, financial advisor. We find some in retirement planning books and articles we read.

If the chart shows an internal rate of return of 10%-12%, double check if investments are yielding those kind of returns. Past trends can be analysed, but not always extrapolated.

If data is beaten hard enough, it speaks the language you want to speak, and that is what a product seller is doing.

Ask questions. Use common sense.

It will save a lot of regrets and repentance later.

NOT COUNTING TAXES

We need to get used to the idea, that post-retirement income comes from multiple sources, not just a salary or business profits.

Not all kinds of income is exempt from returns.

We need to think about various methods of generating passive income, and make a provision for taxation on that, as per slabs prevalent now.

For example, selling stocks or real estate will attract capital gains tax.

SENIOR CITIZEN HEALTH INSURANCE

Healthcare is a major expense in golden years.

One needs to do a thorough study of health insurance schemes in the country of your residence. Consider this as applicable, even if you are entitled to lifelong free medical care. This is about those who retire from government or defence services, or qualify under some scheme where the state takes care of your medical expenses.

Rules can change. One may not always find a network hospital in close vicinity. The quality of treatment received for a particular ailment, or surgeons in a particular hospital may not be the best.

A retirement plan can never be perfect, due to the uncertainty of timelines. You can’t afford to be over-optimistic or too pessimistic, as options are limited.

Incorporate flexibility with a Plan B and C and D in retirement plans, cultivate the right mindset, and enjoy the period of freedom from earning money for sustenance.