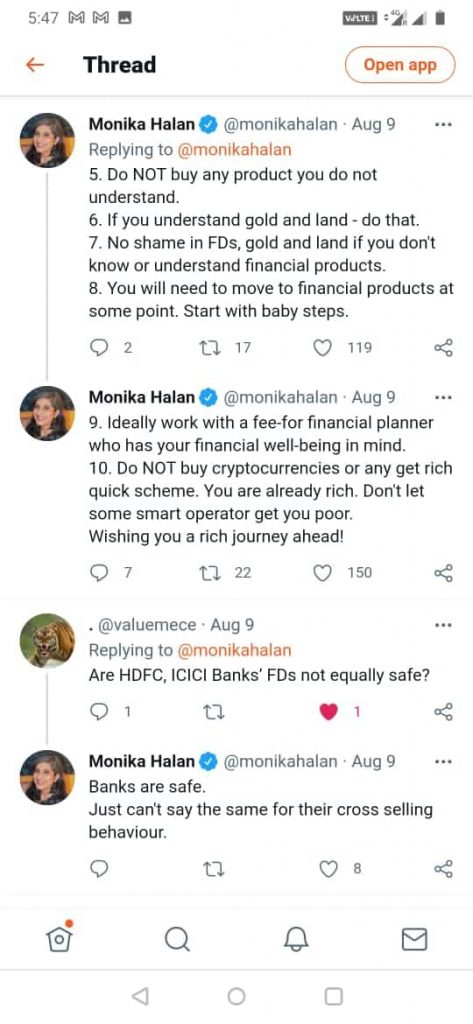

I came across an interesting tweet today. Somebody asked Monika Halan, former editor of LiveMint for advice on how the Olympic medal winners should handle their windfalls.

It is something that merits attention. We call their prize money a windfall, because it is not regular income. Most of them come from humble backgrounds, and have to plan a future with this money. The glamour and public attention will last only for a couple of months or years.

The question is where do they see themselves after a few years. What will be their investment and returns, if they continue to train themselves or coach others? What are the opportunities available, and what do they need to do to get those?

EARLY RETIREMENT

One may seek early retirement for personal reasons or be forced into it. Reasons can be multifarious.

- Retrenchment

- Being forced to quit in the pandemic to be a caregiver

- Winding up of a small business in a slow economy

Everybody does some calculations on an excel sheet, with or without the help of a financial planner to check if they can survive.

I don’t have anything against retirement planning on excel sheets. Excel sheets are a tool to make calculations easier.

However, I’d much prefer to give people a vision board, and ask them to paste pictures of how they see themselves after early retirement. It helps in clarifying concepts, before getting down to number-crunching.

I gained clarity on a few subjects after talking to people, and watching them closely after retirement.

WHAT WILL YOU GAIN AFTER EARLY RETIREMENT?

1. Flexibility of Time

- Having more time on hands feels enormously liberating, if you have productive things to fill up the slots.

- It is great to wake up late and not feel guilty about it. One can adjust schedules accordingly.

- It is also great to explore new options, learn new things, up skill and re-skill yourself. There may be a new earning opportunity somewhere.

- Who has the time to blog or do travel photography, while in a corporate job?

2. Financial Freedom

If you have planned well, you have a monthly income to cover your basic needs without working for it.

It leaves you free to take a risk in some other field.

3. Flexibility of Lifestyle

You need not dress formal, do business entertaining, travel business class or be seen only in select circles in line with your corporate tag.

My Quora answer on the subject with close to a million views and 1.3K upvotes

WHAT WILL YOU LOSE AFTER EARLY RETIREMENT?

1. Status

You may see your former colleagues rise up the ladder, and wonder where you would have been.

2. Identity

You are not the label your company gives you. But the labels get entrenched in identity and self worth. One may feel lost for some time.

Watch this video, where Rinku Bhardwaj talks about how she identified herself with her payslip.

4 THINGS I SACRIFICED BY RETIRING EARLY

3. Opportunities

Certain jobs give you the platform to be creative, contribute to society. The same is not possible in an individual capacity.

4. Rising income graph

You have plateaued somewhere with early retirement.

It can be a pivot for better things. It can also be a battle against inflation and rising cost of living.

5. Returning to a company or assignment

Active employment makes it easier to switch jobs and return to a previous company if so desired. A break or a voluntary retirement makes it difficult beyond a certain age. One can expect to take up consulting or freelancing assignments, but not full employment with all perks restored.

WHAT DO YOU NEED TO FOCUS ON?

1. Welfare of your dependents

How will your family be placed, in case you move on and a pension or some other source of income stops?

2. Financial Security

Gone are the days of gambling on high-risk investments. One needs to first secure whatever you own, then strategise growth.

3. Being Debt-Free

Reduce or eliminate debt as much as possible by settling loans. Interest is a luxury one cannot afford.

4. Estate Planning

Are you okay with leveraging your assets to fund a future lifestyle? Or are you stuck with the idea of leaving a legacy?

How you view and utilise your assets is crucial to your future income.

Download Future of your Money to understand your money mindset

Here is the Twitter conversation we started the blog with. Note her focus on safe investments.

Need I say more?