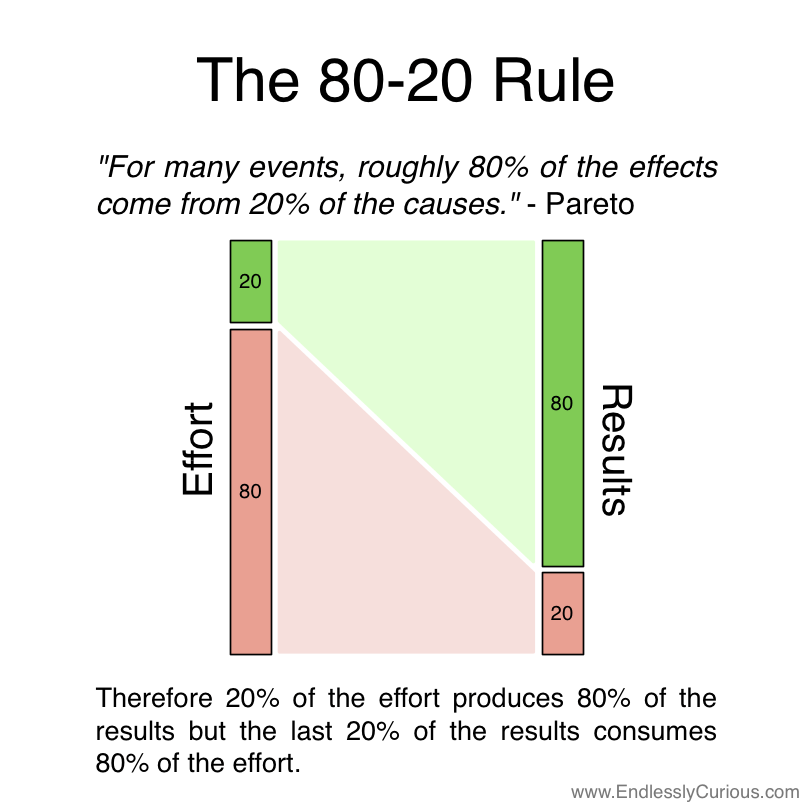

What does the 80:20 rule or Pareto Principle bring to mind?

Our gurus have drilled into us since childhood that 20% of efforts will fetch 80% of results.

There are others who made us memorize the formula to calculate compound interest.

Now, what’s the problem here?

The results of both the principles take so long to manifest, that we are mature adults when we accept that it’s true. And it may happen, that we did not expend efforts in line with our goals.

“Put life first and build systems to support life instead of putting money (work) first and having your family support your career.”

― Richie Norton

80 20 RULE FOR SAVING MONEY

The Pareto Principle when applied to personal finance is very simple and oft-repeated.

80% of your net take home income should go towards your expenses.

The remaining 20% should go to savings and then investments.

But into which investments and how much?

ASK THE HORSE

A man riding a horse is asked where is he going.

The quick answer is “Ask the horse”.

For some people, their financial advisor is the horse.

Have you shared all your passions and priorities with your financial planner?

80 20 RULE FOR GOAL-SETTING

Amar’s greatest passion in life is to travel around the world. He fails to mention this to the financial planner. He gets an investment plan to build up the down-payment needed to buy a house and car. A home loan and car loan will take care of the goals, and a larger part of his income will go to loan repayment. He keeps thinking he will save for the world tour, after meeting other goals. Responsibilities keep adding up, as he gets married and has two lovely children. His wife’s dream is to own a beach-front house. His own dream takes a back seat.

What could have been different here?

Amar could have dedicated a small part of his income (1%-2% is also fine) to the travel goal. In a few decades, he would have had a decent amount to fulfil his dream, even if the amount seemed negligible at the beginning.

Related post: What is your investing endgame?

OPPORTUNITIES ARE DISTRACTIONS

Amar reads about the fantastic returns some people earn in forex trading, and is tempted to divert resources. Unfortunately, he fails to make expected profits as market conditions change. He has not lost money, but remains where he is.

Alternatively, his money could have continued to grow in the original investment plan.

What seems like a super opportunity may actually take you further away from your goals.

WHAT HAPPENS WHEN YOUR GOALS ARE CLEAR?

You have listed down goals in chronological order.

- Have you listed them in order of priority? What is closest to your heart?

- What kind of plans do you choose for the goals with highest priority?

Certain plans are low or zero-risk like small savings schemes sponsored by government, public provident fund etc. where one moves slow and steady, and gets the money only after a specified period. Gold and bank fixed deposits are time-tested instruments where investors have never lost money.

Related post: Budget-proof your personal financial plan

Mutual funds deliver good returns in medium to long term, but are subject to market risk.

Cryptocurrency and non-fungible tokens are for those with a high-risk appetite, but can deliver good returns in the short term, if played well.

CHOOSE THE RIGHT MOMENTUM

The momentum of your investment plan should match the urgency and passion for your goals.

If the goal is precious, it should be parked in safe plans. It is the 20% effort, which will lead to 80% of life satisfaction.

The way to create something great is to create something simple.

― Richard Koch

Money to keep up with trends can be earned through small amounts invested in comparatively high-risk plans. You may have to invest more effort for quick results.

Innovation is the name of the game;

It may be that you will be happiest in the rat race; perhaps, like me, you are basically a rat.

― Richard Koch, The 80/20 Principle: The Secret to Achieving More with Less