A RBI circular for banks on renewal of bank fixed deposits has sparked off a misleading trail of posts on social media.

An article on Zee News reported incomplete facts, bundled with general information on bank fixed deposits added to the confusion.

New FD Rules – Claim your money as soon at the fixed deposit matures or you will face a loss

WHAT THE VIRAL SOCIAL MEDIA POST SAYS

It conveys the impression, that banks automatically renewed fixed deposits in the past, and hereafter, the practice will be stopped. Banks will not renew fixed deposits, and the client will earn only savings rate on it.

It urges holders of bank fixed deposits to diarise the dates of maturity, and take necessary steps to renew the FD on time. Not doing this may lead to loss of interest, as the bank will pay only savings bank deposit rate, which is lower than the FD rates.

WHAT ARE THE FACTS ABOUT RENEWAL OF BANK FIXED DEPOSITS?

Private banks ask for clear instructions on what is to be done on maturity, at the time of opening the deposit account.

Options given are

- Renew automatically on date of maturity for same period

- Credit proceeds on maturity to savings or current account number ….. (account in the same bank)

- Remit proceeds on maturity to savings or current account number …. (account in another bank).

The bank starts sending reminders a few days before maturity by SMS and email, giving the client time to decide what is to be done with the maturity amount.

Automatic renewal leads to a renewal for the same period, at the prevailing rate of interest. It may not always be in the best interest of the client. Yet, some depositors opt for it if they are not in a position to track the status and make fresh deposits again. It is convenient for people travelling abroad, or people not well-versed with net banking. It saves the trouble of visiting the bank on maturity of a FD.

A loss of interest to the client occurs only if they allow the maturity amount to remain in the savings account, and do not create a fresh deposit on the same day.

HOW HAVE BANK FD INTEREST RATE TRENDS CHANGED?

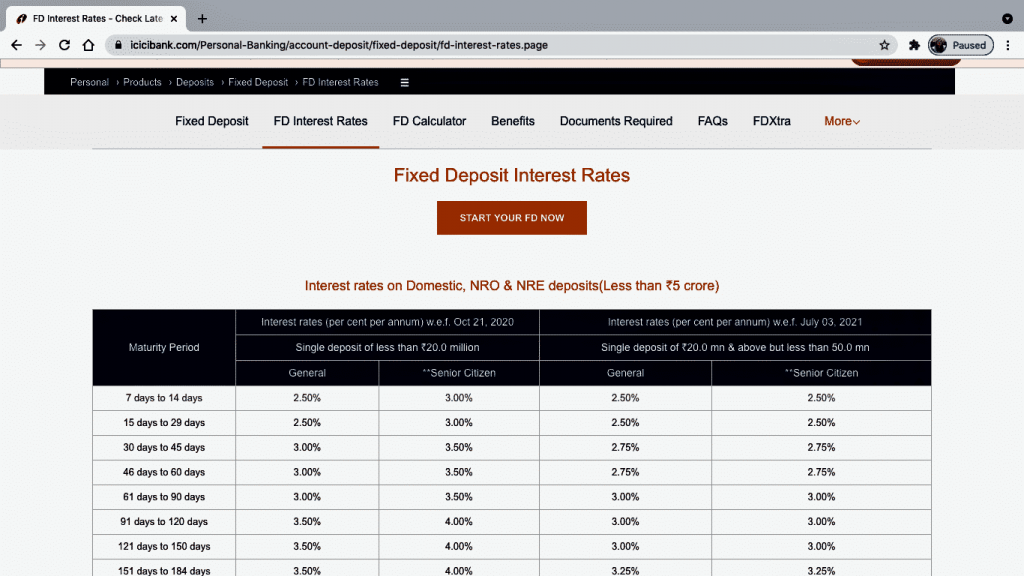

ICICI Bank offers an interest rate of 3% p.a. on savings accounts with a balance below Rs. 50 lakhs.

See the prevalent FD rates.

FDs placed for a period less than 90 days fetch a rate of interest lower than the savings rate.

The client will benefit in these cases.

This is just an example of the anomaly in the “savings rate low, FD rates high” impression that customers carry.

WHAT DOES THE RBI CIRCULAR SAY?

The RBI circular issued on 2nd July, 2021 says

“…..it has been decided that if a Term Deposit (TD) matures and proceeds are unpaid, the amount left unclaimed with the bank shall attract rate of interest as applicable to savings account or the contracted rate of interest on the matured TD, whichever is lower.”

As per previous instructions, banks had to pay savings rates, which may be higher in some cases. RBI has corrected the anomaly to prevent a loss to banks, as clients may not intentionally renew short-term fixed deposits.

There is no adverse impact on the client’s interest. Only the banks’ interest has been protected.

The change is from

“rate of interest applicable to savings account”

to

“rate of interest as applicable to savings account or the contracted rate of interest on the matured TD, whichever is lower.”

The impact is more on high-value and interbank deposits, rather than retail depositors.

WHAT IS A BANK RETAIL DEPOSITOR SUPPOSED TO DO?

- Give clear instructions for maturity while making a new FD.

- If the same has not been done, respond to the bank’s reminders on maturity of the FD, and tell them what to do.

- Open net banking on the date of maturity, and make a fresh fixed deposit for a period and rate of interest best suitable to you.

- If you have given instructions for automatic renewal, check if the interest rates and period still suits your interest. You have the option to change it before date of maturity. If you wish to change the status even a day after renewal, the bank will treat it as premature withdrawal of deposit.

Download Ebooks for a quick read.