High yield savings accounts look attractive when you need to park money for the short term. RBI is in process of increasing the repo rate, but interest rates on FDs to reach maximum levels may take 3-4 months to reach a stable peak.

The advice you hear pouring from all sides is “Do not be in a hurry to book long-term fixed deposits”. But where do you park your money till then, if a FD matures or you have a good sum to be invested?

A FD INVESTOR’S DILEMMA

Most of the private sector banks have pegged short-term deposit rates below the savings rate. So, booking a short-term FD will not make sense.

State Bank of India offers short-term deposit rates above the savings account interest rate. But then, the rate of interest offered on savings account is only 2.7%.

Liquid funds yield negligible returns in the short term as of now. Investments in direct equity or any market-linked investments are subject to market risk.

WHAT ARE HIGH-YIELD SAVINGS ACCOUNTS?

High yield-savings accounts are high-interest savings accounts. We enjoy the benefits of high returns with liquidity, with terms and conditions applicable.

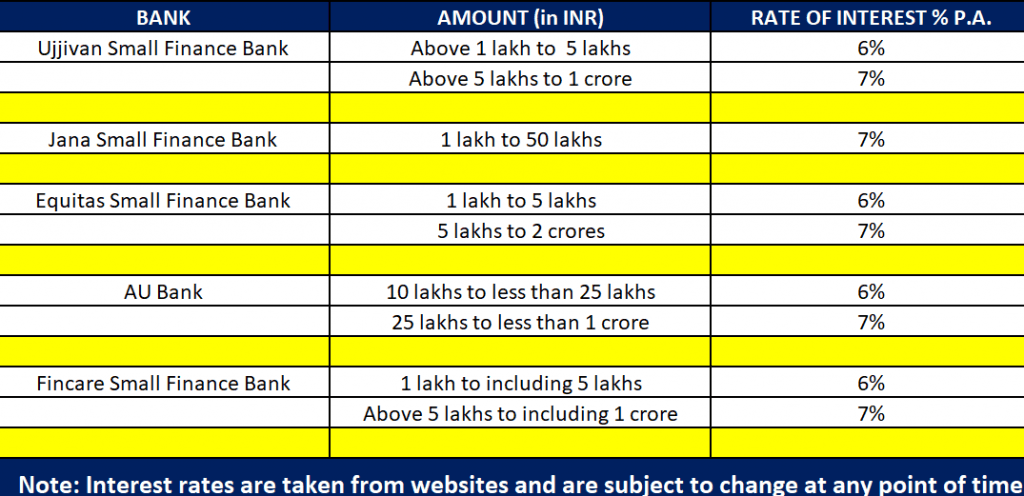

There are seven small finance banks which offer an interest rate of 6%-7% p.a. for high-value savings accounts.

But small finance banks do not have pan-India branch networks, and a physical branch may not be accessible to all. Obviously, the need is for digital savings accounts which can be opened online.

HOW TO OPEN A DIGITAL HIGH YIELD SAVINGS ACCOUNT?

You can open a digital savings account, if you possess PAN and Aadhar card, a mobile phone linked to the Aadhar number to receive OTP and a device with internet connection for video-KYC procedures to be carried out. You need to be ready with the KYC documents and a white sheet of paper and black pen for your signature.

CONDITIONS FOR OPENING A DIGITAL SAVINGS ACCOUNT

These accounts are called partial KYC accounts or OTP-based KYC accounts. Some banks demand that you should not hold a similar account in any other bank.

Some banks make the facility available only for New-to-Bank accounts, and not for those already holding an account in the same bank.

The maximum validity period for digital savings accounts may be 365 days, unless copies of KYC documents are submitted in the bank.

A certain bank specifies a maximum deposit limit of Rs.90,000/- for digital accounts. Here the facility is not available for high-value deposits.

ARE HIGH-YIELD SAVINGS ACCOUNTS TAXED?

Yes.

Income tax applies on interest earned on savings deposits, if it exceeds Rs.10,000/- in a year.

Hence, deposits above Rs.1,42,000/- @ 7% p.a. and Rs.1,66,000/- @ 6% p.a. will attract income tax at rates applicable to you.

ARE HIGH-YIELD SAVINGS ACCOUNTS SAFE?

Deposit Insurance Credit Guarantee Corporation (DICGC) insures deposits up to Rs. 5 lakhs held in a single name or single holding pattern. The limit of Rs. 5 lakhs will apply to sum total of savings and fixed deposits in the same bank.

You can check if a bank is subscribed to DICGC here.

DO HIGH YIELD SAVINGS ACCOUNTS BEAT INFLATION?

Current inflation rate is high bordering on 8%. Hence, most of the investments in bank deposits will not beat inflation in the short term.

We are looking at options comparatively better than placing money in popular savings accounts which yield interest in the range of 2.7% – 4% p.a.

WHICH SMALL FINANCE BANKS SHOULD BE CONSIDERED?

We shortlisted five small finance banks which offer high interest rates on savings accounts along with a facility to open digital savings accounts.

Check high yield savings account rates and other terms and conditions on the bank’s website before opening an account.

Related post: How to earn high higher returns on savings accounts?