Fintech is a word bandied about relentlessly in start-up and investor groups, in discussions about money management and online security. If brick-and-mortar banks are referred to as staid and old world, perhaps they are so, or soon will be. The world before and after the internet and mobile phone is vastly different. Fintech promises to change your life in the same way.

Related post: Read Fundamentals on FinanceOnline.

The internet finds users who get addicted to platforms and apps, but are not fully aware of how it functions, and how it can be misused by criminals to fool or defraud others. Unfortunately, fintech is going the same way.

Everybody likes to see money moving at the push of a button. It gives an immense sense of power.

You should indeed, cultivate a financial muscle and power by smart use of technology.

HOW IS FINTECH CHANGING YOUR WORLD?

You are used to seeing electronic versions of the money in your bank accounts and stock market holdings. Insurance will soon follow suit. Insurance companies will issue all new policies in electronic version. A system for conversion of existing policies in physical version will be rolled out soon.

Needless to repeat, we are getting more and more exposed to possibilities of fraud. While banks and IT keep fighting in tandem to counteract the miscreants, we need to follow a basic discipline to ensure safety. After all, it’s our money that we seek to protect.

Let us look at a few options – both new and old, to see how it works for you optimally.

AUTO-DEBIT – Do you see it as fintech?

This is as old as banking systems go. Only it was called “ECS- Electronic Clearing System” or standing instructions given to the bank vide an application.

The system stands good for your investments like Systematic Investment Plan (SIP) or Recurring Deposits (RD). Micro-investing apps like Roundups and Jar leverage the same mechanism by debiting your account with small amounts and investing in gold or mutual funds.

A suggestion made by Monika Halan in “Let’s talk Money” will become as classic as the 50:30:20 system espoused by Elizabeth Warren.

She recommends three savings accounts – one each for receiving income, expenses and investments. Money received in the first account is transferred to the other two in a predetermined ratio by auto-debit. Thus, you have a fixed amount available for expenses and you need to manage within that amount.

Ideally, refrain from having a debit card or payment app linked to the income or investment account. It takes away the option of spending money which is not earmarked for expenses.

DIGITAL WALLET APPS

Digital wallets are the ones where you need to load money – like PayTM or Ola Money. It stores money in digital version just like you carry cash in your pocket. But of course, it needs to be funded from your bank account using a credit or debit card.

Payment apps like Google Pay just transfer money from your linked bank account to the recipient. It is a money transfer app which does not store money.

A majority of online frauds happen through G-Pay, because the other party is interacting with your bank account, and can draw money with the help of mis-directed moves.

A digital wallet can be defrauded only with the amount stored in the wallet, which is not high.

Closed wallets allow expenses only on their own platform. Semi-closed wallets like PayTM allow you to spend in merchant establishments within their network. Open wallets allow cash withdrawal, but this is not a common feature.

Caution

Digital wallets eliminate the exposure of credit and debit card numbers to hackers. At the same time, the bank will not take responsibility for any loss through a digital wallet. They do help if you wish to hotlist a lost card or track an impersonator.

NEO-BANKS

Neo-banks are online banks with no physical presence. They are usually sponsored by a bank (ICICI, RBL, IDFC) to target millennials and new users in the financial system.

Common ones are Jupiter, Neo, Fam Pay, Instant Pay, Atlantis and Razor Pay.

Caution

Check who is the owner of the app, and if it is licensed by RBI. Download apps only from authorised app stores.

BUDGETING AND EXPENSE –TRACKING APPS

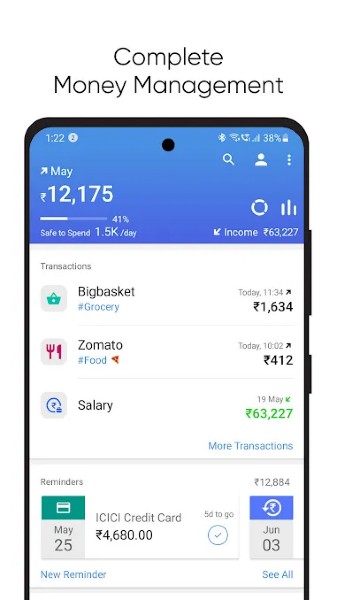

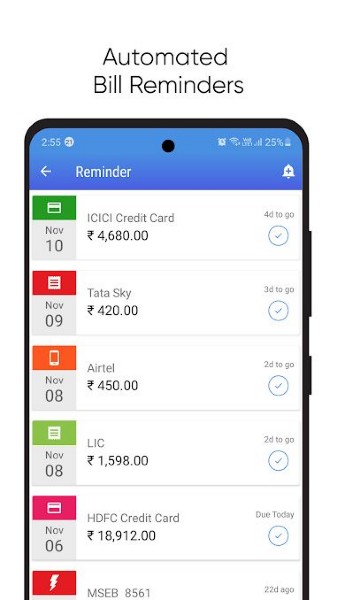

Budgeting apps are the ones where one inputs both the budgeted figure and actual expenses. The app tells you if you are within safe limits or exceeding the budget.

The common ones used in India are Mint, You Need a Budget (YNAB), Personal Capital, Good Budget and Budget Guard. Most of the apps have both free and paid versions. The paid versions offer more solutions and services.

Some apps provide free services like interest calculators, bank and ATM locators and financial updates.

Money Manager helps you track your account balance, by auto-adjusting income and expenses against it.

Expense-tracking apps just classify your expenses into categories such as food, entertainment, transport etc.

The best free expense tracking apps are Axio (previously called Walnut) and Money Lover.

Expense – splitting apps like Split-wise help you to divide expenses in a group.

Some of these demand access to Messages on your phone and draw information on what have you spent.